In the same month, The UK’s Financial Conduct Authority added Revolut to its list of companies authorized to offer cryptocurrency products and services it had offered crypto trading since 2017 but had not been regulated. In September 2022, Revolut confirmed a cyberattack exposed personal data of 50,000 of its 20m customers. In March 2022, Revolut had 18 million customers around the world and was making 150 million transactions a month. In March 2022, after Russia invaded Ukraine, Storonsky publicly opposed the war in Ukraine and Revolut donated £1.5 million to the Red Cross Ukraine appeal. In January 2022, Revolut launched as a bank (instead of an e-money institution) in 10 additional European countries: Belgium, Denmark, Finland, Germany, Iceland, Liechtenstein, Luxembourg, Netherlands, Spain, and Sweden. In July 2021, Revolut raised US$800 million from investors, including SoftBank Group and Tiger Global Management, at a US$33 billion valuation. In March 2021, Revolut applied for a bank charter in the US via applications with the FDIC and the California Department of Financial Protection. In January 2021, the company announced that it had applied for a UK banking licence.

In November 2020, Revolut became profitable. In August, the company launched its financial app in Japan.

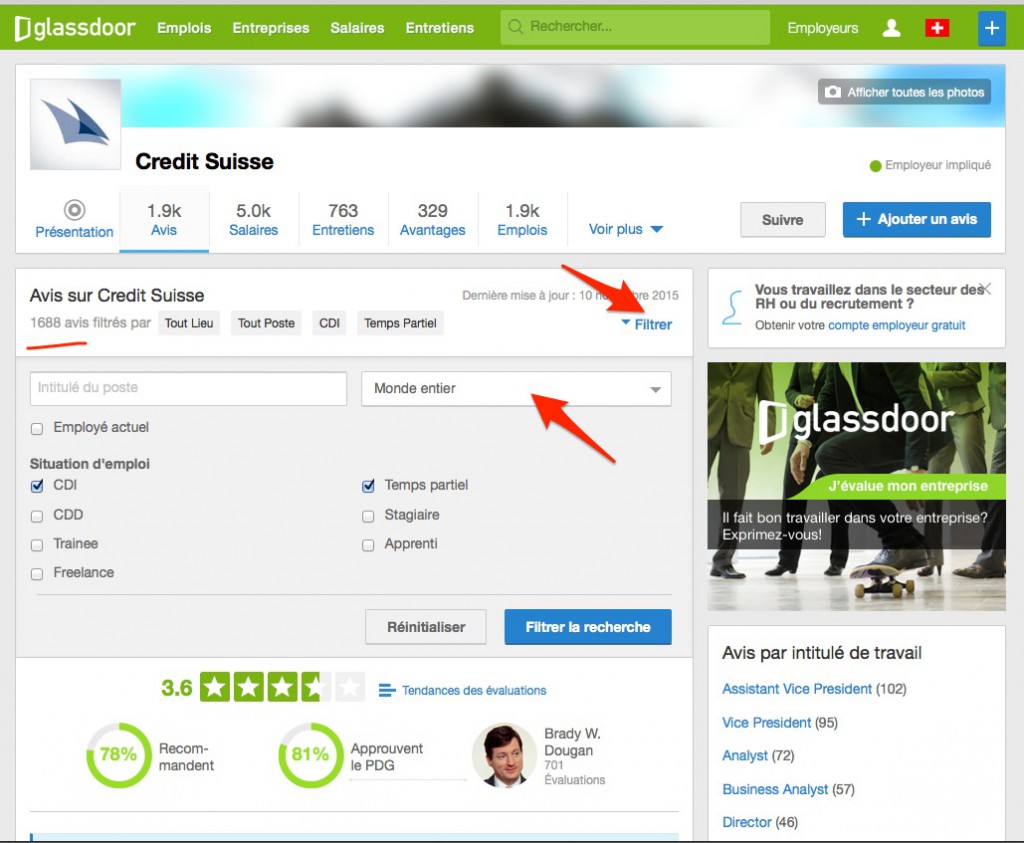

In March 2020, Revolut was launched in the United States. In February 2020, Revolut completed a funding round that more than tripled its value, valuing the company at £4.2 billion and becoming the United Kingdom's most valuable financial technology startup. In October 2019, the company announced a global deal with Visa, following which it expanded into 24 new markets and hired 3,500 additional staff. In August 2019, the company announced several hires with experience in traditional banking, including Wolfgang Bardorf, formerly executive director at Goldman Sachs and the global head of liquidity models and methodologies at Deutsche Bank, Philip Doyle, previously head of financial crime at ClearBank and fraud prevention manager at Visa, and Stefan Wille, previously senior vice-president of finance at N26 and corporate finance manager at Credit Suisse. This was subsequently made available to all users. In July 2019, Revolut launched commission-free stock trading on the New York Stock Exchange and Nasdaq, initially for customers in its Metal plan. TechCrunch reported that he had quit following allegations of compliance lapses, however Revolut denied that he had left for these reasons. In March 2019 Revolut united with Dax, the same year the company's chief financial officer Peter O'Higgins resigned. At the same time, an Electronic Money Institution licence was also issued by the Bank of Lithuania. In December 2018, Revolut secured a Challenger bank licence from the European Central Bank, facilitated by the Bank of Lithuania, authorising it to accept deposits and offer consumer credits, but not to provide investment services. DST Global was founded by Yuri Milner, who has been backed by the Kremlin in his previous investments. It had a post-funding valuation of US$1.7 billion, making it a unicorn.

Requirements manager credit suisse glassdoor series#

On 26 April 2018, Revolut raised $250 million in Series C funding. It began offering cryptocurrency services in 2017, beginning with crypto trading. The company was originally based in Level39, a financial technology incubator in Canary Wharf, London. Revolut was founded on 1 July 2015 by Nikolay Storonsky from Russia and Vlad Yatsenko from Ukraine. Since Revolut does not have UK bank status, it does not reimburse victims of authorized push payment fraud in that country, and the £85,000 protection of funds deposited in a bank by the Financial Services Compensation Scheme is not available for e-money. A US$800 million funding round in July 2021 brought the company's valuation to US$33 billion, making it the most valuable UK tech startup at the time. In January 2021 Revolut applied for a UK banking licence, but as of December 2022 the outcome was still awaited. In November 2020 it was breaking even and, with a £4.2 billion valuation became the UK's most valuable fintech company.

In 2020 Revolut expanded into Japan and the US and expanded its staff from 1,500 to 6,000. It offers accounts featuring currency exchange, debit cards, virtual cards, Apple Pay, interest-bearing "vaults", stock trading, crypto, commodities, and other services. Headquartered in London, it was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Revolut Bank UAB is licensed and regulated by the Bank of Lithuania within the European Union. Revolut is a global neobank and financial technology company that offers banking services.

0 kommentar(er)

0 kommentar(er)